Swisscom (SCMWY)

(Delayed Data from OTC)

$71.85 USD

-1.90 (-2.58%)

Updated Aug 28, 2025 02:19 PM ET

3-Hold of 5 3

F Value B Growth D Momentum D VGM

Share your opinion

Price, Consensus & Surprise

Quote Overview

Stock Activity

- Open

- 71.71

- Day Low / High

- 71.50 - 71.85

- 52-Wk Low / High

- 54.66 - 74.60

- 20-Day Avg Vol

- 10,852

- Market Cap

- 382.04 B

- Dividend

- 1.61 ( 2.18%)

- Beta

- 0.30

Research Report for SCMWY

All Zacks’ Analyst ReportsKey Earnings Data

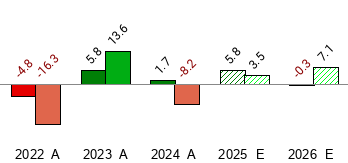

Sales and EPS Growth Rates (Y/Y %)

Sales |

EPS |

Zacks Rank Factors

Agreement Estimate Revisions (60 Days)

| Q1 | Q2 | F1 | F2 | |

|---|---|---|---|---|

| # of Analysts | NA | NA | 2 | 1 |

| # of Revisions | NA | NA | 0 | 0 |

| # Up | NA | NA | 0 | 0 |

| # Down | NA | NA | 0 | 0 |

| % Revision Agreement: |

Magnitude Consensus Estimate Trend (60 Days)

| Q1 | Q2 | F1 | F2 | |

|---|---|---|---|---|

| Current | NA | NA | 3.50 | 3.75 |

| 7 Days Ago | NA | NA | 3.50 | 3.75 |

| 30 Days Ago | NA | NA | 3.50 | 3.75 |

| 60 Days Ago | NA | NA | 3.50 | 3.75 |

| Trend of Estimate Revisions: |

0% |  0% |

Upside Most Accurate Estimate vs. Zacks Consensus

Q1 |

Q2 |

F1 |

F2 |

|

|---|---|---|---|---|

| Most Acc. Est. | 0.00 | 0.00 | 3.50 | 3.75 |

| Zacks Cons. Est | 0.00 | 0.00 | 3.50 | 3.75 |

| Difference | 0.00 | 0.00 | 0.00 | 0.00 |

| Earnings ESP %: | no-arrow | no-arrow | no-arrow | no-arrow |

| 0.00% | 0.00% | 0.00% | 0.00% |

Surprise EPS Surprise (last 4 quarters)

| Q0 (6/25) | Q-1 (3/25) | Q-2 (12/24) | Q-3 (9/24) |

|

|---|---|---|---|---|

| Reported | 0.61 | 0.79 | 0.57 | 1.00 |

| Estimate | NA | 0.92 | 0.91 | NA |

| Difference | NA | -0.13 | -0.34 | NA |

| EPS Surprise %: |  |  |  |  |

| NA | -14.13% | -37.36% | NA |

Value Scorecard

Growth Scorecard

Momentum Scorecard

| Value Score | SCMWY: F | Industry [X] | LUMN: A | VIV: B | TU: C |

|---|---|---|---|---|---|

| Zacks Rank | 3 | 3 | 3 | 4 | |

| VGM Score | D | A | B | C | |

| Cash/Price | 0.00 | 0.08 | 0.33 | 0.08 | 0.11 |

| EV/EBITDA | 77.13 | 6.82 | 5.22 | 5.01 | 8.52 |

| PEG Ratio | NA | 2.01 | NA | 0.86 | 4.85 |

| Price/Book (P/B) | 27.18 | 2.16 | NA | 1.71 | 2.16 |

| Price/Cash Flow (P/CF) | 85.23 | 6.09 | 1.94 | 5.60 | 6.09 |

| P/E (F1) | 21.10 | 18.09 | NA | 18.89 | 22.57 |

| Price/Sales (P/S) | 25.38 | 1.33 | 0.42 | 2.04 | 1.70 |

| Earnings Yield | 4.73% | 5.35% | -18.60% | 5.31% | 4.42% |

| Debt/Equity | 1.08 | 0.62 | -29.52 | 0.20 | 1.72 |

| Cash Flow ($/share) | 0.87 | 1.90 | 2.71 | 2.25 | 2.71 |

| Growth Score | SCMWY: B | Industry [X] | LUMN: C | VIV: B | TU: C |

|---|---|---|---|---|---|

| Zacks Rank | 3 | 3 | 3 | 4 | |

| VGM Score | D | A | B | C | |

| Hist. EPS Growth | -1.28% | -1.28% | -50.15% | 1.81% | -3.37% |

| Proj. EPS Growth | 3.40% | 2.34% | -366.67% | 5.95% | -3.76% |

| Curr. Cash Flow Growth | -2.49% | 1.11% | -13.44% | -0.74% | 1.11% |

| Hist. Cash Flow Growth | 1.58% | -1.28% | -15.10% | -1.79% | 4.53% |

| Current Ratio | 0.74 | 0.86 | 2.13 | 0.98 | 0.86 |

| Debt/Capital | 51.84% | 50.57% | 98.36% | 16.56% | 63.26% |

| Net Margin | 9.29% | 7.85% | -9.19% | 10.13% | 4.67% |

| Return on Equity | 10.05% | 10.10% | -158.40% | 8.32% | 9.10% |

| Sales/Assets | 0.37 | 0.39 | 0.38 | 0.45 | 0.35 |

| Proj. Sales Growth (F1/F0) | 5.83% | 0.00% | -5.43% | 2.21% | 1.44% |

| Momentum Score | SCMWY: D | Industry [X] | LUMN: C | VIV: D | TU: D |

|---|---|---|---|---|---|

| Zacks Rank | 3 | 3 | 3 | 4 | |

| VGM Score | D | A | B | C | |

| Daily Price Chg | -0.52% | 0.13% | 12.37% | -0.63% | 0.61% |

| 1 Week Price Chg | -0.07% | 0.69% | 18.96% | 1.78% | -0.24% |

| 4 Week Price Chg | 4.11% | 3.68% | 18.16% | 12.49% | 1.98% |

| 12 Week Price Chg | 6.34% | 6.98% | 34.78% | 21.37% | 0.61% |

| 52 Week Price Chg | 15.50% | 14.03% | -1.50% | 35.30% | 2.74% |

| 20 Day Average Volume | 10,852 | 163,223 | 13,874,998 | 948,749 | 2,960,429 |

| (F1) EPS Est. Wkly Chg | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| (F1) EPS Est. Mthly Chg | 0.00% | 0.00% | 3.45% | -2.20% | -3.40% |

| (F1) EPS Est. Qtrly Chg | 0.00% | 2.66% | 3.45% | 2.69% | -3.21% |

| (Q1) EPS Est. Mthly Chg | NA | 0.00% | 45.83% | 0.00% | -8.75% |