We don’t buy emojis, “hot tips,” or hopelessly complicated ETFs. We build positions in healthy, growing businesses. CenterPoint Energy Inc. (CNP) is one example. It just increased its 2025 guidance almost a month ahead of its regular report, observes Roger Conrad, editor of Conrad’s Utility Investor.

To assess companies’ quality, we focus on five basic criteria:

- Long-term sustainability of dividend policy

- Revenue reliability

- Regulatory relations

- Balance sheet

- Operating efficiency

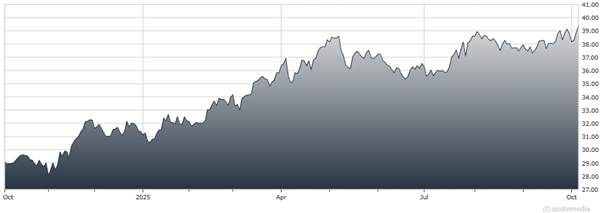

CenterPoint Energy Inc. (CNP)

Together, they answer the basic question of whether a company’s business is getting stronger and therefore more valuable. If the answer is yes, its securities are worth owning, especially the common stock that represents ownership and participation in growth. If the answer is no, the best course is to move on.

(Editor’s Note: Roger will be speaking at the 2025 MoneyShow/TradersEXPO Orlando, scheduled for Oct. 16-18. Click HERE to register.)

At CNP, this was the second consecutive quarter management boosted its outlook. And the primary spur is simply accelerating demand for electricity, which will require record levels of investment to meet.

It’s the same formula that’s fueling growth at other electric utilities. And the primary sources of demand growth — Artificial Intelligence (AI) enabled data centers, re-shoring of supply chains to the US, electrification of industry, and transportation and population growth — is spurring investment in natural gas distribution and transportation, communications networks, and even water utilities.

Recommended Action: Buy CNP.

Subscribe to Conrad’s Utility Investor here…

Read full article here »

CNP- A Utility Profiting from Surging Power Demand

We don’t buy emojis, “hot tips,” or hopelessly complicated ETFs. We build positions in healthy, growing businesses. CenterPoint Energy Inc. (CNP) is one example. It just increased its 2025 guidance almost a month ahead of its regular report, observes Roger Conrad, editor of Conrad’s Utility Investor.

To assess companies’ quality, we focus on five basic criteria:

CenterPoint Energy Inc. (CNP)

Together, they answer the basic question of whether a company’s business is getting stronger and therefore more valuable. If the answer is yes, its securities are worth owning, especially the common stock that represents ownership and participation in growth. If the answer is no, the best course is to move on.

(Editor’s Note: Roger will be speaking at the 2025 MoneyShow/TradersEXPO Orlando, scheduled for Oct. 16-18. Click HERE to register.)

At CNP, this was the second consecutive quarter management boosted its outlook. And the primary spur is simply accelerating demand for electricity, which will require record levels of investment to meet.

It’s the same formula that’s fueling growth at other electric utilities. And the primary sources of demand growth — Artificial Intelligence (AI) enabled data centers, re-shoring of supply chains to the US, electrification of industry, and transportation and population growth — is spurring investment in natural gas distribution and transportation, communications networks, and even water utilities.

Recommended Action: Buy CNP.

Subscribe to Conrad’s Utility Investor here…

Read full article here »