The market for online home goods and furniture is very competitive.

That hasn’t stopped Wayfair, one of the world’s leading online sellers of home goods products, from generating higher profits amid a new growth strategy supported by robust marketing efforts and stronger app engagement.

Wayfair, a Zacks Rank #2 (Buy), engages in the e-commerce business in the United States and internationally. The stock is displaying relative strength, breaking out to the upside amid a bullish move that pushed shares to fresh 52-week highs.

The price movement is a sign of strength as we head deeper into the second half of the year. Increasing volume has attracted investor attention as buying pressure accumulates in this top-ranked stock.

Company Description

Wayfair offers online selections of furniture, décor, housewares, and home improvement products. It operates worldwide through Wayfair.com and four other branded websites including Joss & Main, AllModern, Birch Lane and Perigold. Wayfair also provides its products under the Three Posts and Mercury Row brands.

The company currently offers more than 40 million products from more than 20,000 suppliers. Wayfair boasts its own logistics network, which contributes significantly to the total shipment of goods to customers. The network is comprised of CastleGate and the Wayfair Delivery Network (WDN).

The online home goods retailer has expanded CastleGate as a multichannel third-party logistics service, enabling suppliers to fulfill non-Wayfair orders through its infrastructure. While CastleGate aids in minimizing damages and speeding up deliveries, WDN enables management of large parcel deliveries and facilitates last-mile delivery services.

Wayfair is deepening its investment in technology and rolling out new AI-powered features to create a more seamless experience for customers along with a more user-friendly inventory management process for suppliers.

Earnings Trends and Future Estimates

Wayfair has built up an impressive reporting history, surpassing earnings estimates in three of the past four quarters. Consistently beating earnings estimates is a recipe for success.

Just last week, Wayfair reported second-quarter earnings of 87 cents per share, a 141.7% surprise over the $0.36/share consensus estimate. Wayfair CEO Niraj Shah remained upbeat following the positive results.

“The second quarter was a resounding success, defined by accelerating sales and share gain, in tandem with expanding profitability. As we have discussed over the last few years, we can and will grow profitability, while taking a significant share in the market,” Shah said.

Management attributed profitability gains to more efficient advertising spending and rigorous analysis of marketing channels. The launch of Wayfair Rewards, a paid loyalty program, has also surpassed preliminary expectations.

The company generated $3.3 billion in total net revenue during the quarter, an increase of 5% relative to the same quarter last year. The average order value during the quarter was $328, up from $313 in the second quarter of 2024.

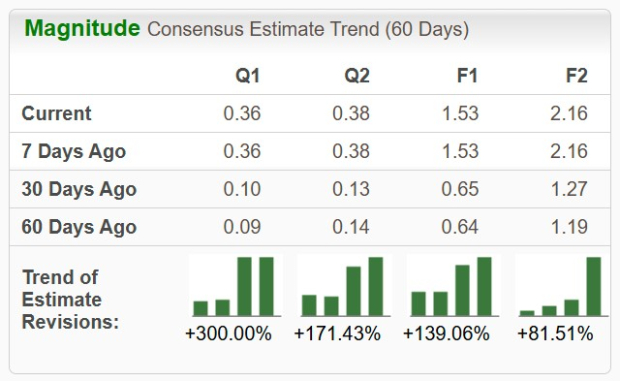

Analysts remain bullish on the stock and have been raising earnings estimates lately. The full-year consensus EPS estimate has been revised upward in the past 60 days by a whopping 139.06% to $1.53 per share. If the company is able to achieve this, it would translate to an astounding 1,076.9% growth rate versus the prior year.

Image Source: Zacks Investment Research

Let’s Get Technical

This market leader has seen its stock advance more than 200% off the April lows. Only stocks that are in extremely powerful uptrends are able to experience this type of outperformance. This is the kind of stock we want to include in our portfolio – one that is trending well and receiving positive earnings estimate revisions.

Image Source: StockCharts

Notice how both the 50-day (blue line) and 200-day (red line) moving averages are sloping up. The stock has been making a series of higher highs throughout the past year. With both strong fundamental and technical indicators, W stock is poised to continue its outperformance.

Empirical research shows a strong correlation between near-term stock movements and trends in earnings estimate revisions. As we know, Wayfair has recently witnessed positive revisions. As long as this trend remains intact (and Wayfair continues to deliver earnings beats), the stock will likely continue its bullish run.

Bottom Line

The impact of tariffs on Wayfair’s business is less than expected and the company is well-positioned to win market share.

Backed by strong brand recognition and a history of earnings beats, it’s not difficult to see why Wayfair stock is a compelling investment. Robust fundamentals combined with an appealing technical trend certainly justify adding shares to the mix.

Recent positive earnings estimate revisions should also serve to create a ‘floor’ in terms of any sudden or unexpected downside moves. If you haven’t already done so, be sure to put Wayfair on your shortlist.

Image: Bigstock

Online Home Goods Retailer Soars to 52-Week High

The market for online home goods and furniture is very competitive.

That hasn’t stopped Wayfair, one of the world’s leading online sellers of home goods products, from generating higher profits amid a new growth strategy supported by robust marketing efforts and stronger app engagement.

Wayfair, a Zacks Rank #2 (Buy), engages in the e-commerce business in the United States and internationally. The stock is displaying relative strength, breaking out to the upside amid a bullish move that pushed shares to fresh 52-week highs.

The price movement is a sign of strength as we head deeper into the second half of the year. Increasing volume has attracted investor attention as buying pressure accumulates in this top-ranked stock.

Company Description

Wayfair offers online selections of furniture, décor, housewares, and home improvement products. It operates worldwide through Wayfair.com and four other branded websites including Joss & Main, AllModern, Birch Lane and Perigold. Wayfair also provides its products under the Three Posts and Mercury Row brands.

The company currently offers more than 40 million products from more than 20,000 suppliers. Wayfair boasts its own logistics network, which contributes significantly to the total shipment of goods to customers. The network is comprised of CastleGate and the Wayfair Delivery Network (WDN).

The online home goods retailer has expanded CastleGate as a multichannel third-party logistics service, enabling suppliers to fulfill non-Wayfair orders through its infrastructure. While CastleGate aids in minimizing damages and speeding up deliveries, WDN enables management of large parcel deliveries and facilitates last-mile delivery services.

Wayfair is deepening its investment in technology and rolling out new AI-powered features to create a more seamless experience for customers along with a more user-friendly inventory management process for suppliers.

Earnings Trends and Future Estimates

Wayfair has built up an impressive reporting history, surpassing earnings estimates in three of the past four quarters. Consistently beating earnings estimates is a recipe for success.

Just last week, Wayfair reported second-quarter earnings of 87 cents per share, a 141.7% surprise over the $0.36/share consensus estimate. Wayfair CEO Niraj Shah remained upbeat following the positive results.

“The second quarter was a resounding success, defined by accelerating sales and share gain, in tandem with expanding profitability. As we have discussed over the last few years, we can and will grow profitability, while taking a significant share in the market,” Shah said.

Management attributed profitability gains to more efficient advertising spending and rigorous analysis of marketing channels. The launch of Wayfair Rewards, a paid loyalty program, has also surpassed preliminary expectations.

The company generated $3.3 billion in total net revenue during the quarter, an increase of 5% relative to the same quarter last year. The average order value during the quarter was $328, up from $313 in the second quarter of 2024.

Analysts remain bullish on the stock and have been raising earnings estimates lately. The full-year consensus EPS estimate has been revised upward in the past 60 days by a whopping 139.06% to $1.53 per share. If the company is able to achieve this, it would translate to an astounding 1,076.9% growth rate versus the prior year.

Image Source: Zacks Investment Research

Let’s Get Technical

This market leader has seen its stock advance more than 200% off the April lows. Only stocks that are in extremely powerful uptrends are able to experience this type of outperformance. This is the kind of stock we want to include in our portfolio – one that is trending well and receiving positive earnings estimate revisions.

Image Source: StockCharts

Notice how both the 50-day (blue line) and 200-day (red line) moving averages are sloping up. The stock has been making a series of higher highs throughout the past year. With both strong fundamental and technical indicators, W stock is poised to continue its outperformance.

Empirical research shows a strong correlation between near-term stock movements and trends in earnings estimate revisions. As we know, Wayfair has recently witnessed positive revisions. As long as this trend remains intact (and Wayfair continues to deliver earnings beats), the stock will likely continue its bullish run.

Bottom Line

The impact of tariffs on Wayfair’s business is less than expected and the company is well-positioned to win market share.

Backed by strong brand recognition and a history of earnings beats, it’s not difficult to see why Wayfair stock is a compelling investment. Robust fundamentals combined with an appealing technical trend certainly justify adding shares to the mix.

Recent positive earnings estimate revisions should also serve to create a ‘floor’ in terms of any sudden or unexpected downside moves. If you haven’t already done so, be sure to put Wayfair on your shortlist.